About Us

Directorate of Logistics is an attached office of the Customs & Indirect Taxes and consists of three Divisions namely Anti-smuggling Division, Marine Division and Communication Division. It was previously known as Directorate of Preventive Operations.The Directorate functions in close co-ordination with the Customs & Indirect Taxes, Chief Commissioners and Commissioners of Customs & Indirect Taxes including DGDRI.

Directorate of Logistics is the nodal agency to monitor the logistical requirements of field formations pertaining to Anti-smuggling, Communication and Marine. This Directorate caters to the needs of about 66 operational Customs Stations along with our international borders, 12 major ports and 36 international ports handling cargo and baggage besides foreign post offices and Land Customs Stations, ICDs etc. which too are vulnerable to smuggling. Thus this Directorate provides logistical support to prevent smuggling through air, sea and land route.

In the year 1994, this Directorate was also entrusted with the work of administering of Customs & Indirect Taxes Welfare Fund, Performance Award Fund and Special Equipment Fund with a view to provide financial assistance for various schemes for the promotion of staff welfare, providing relief in natural calamities and for acquisition of Anti-smuggling equipment of specialized nature within the shortest possible time. Work relating to allocation of funds for upgradation of Ranges under 1% incentive scheme was assigned to this Directorate in the year 2007.

Now the work relating to Customs & Indirect Taxes Welfare Fund and Performance Award Fund has been entrusted to Directorate General of Human Resource Development, New Delhi.

The highlights of Directorate of Logistics functions as under

(a). Anti-smuggling Division deals with the following functions:

1. Assessment of the needs of Anti-smuggling Equipment of field formations, formulations of proposals for their purchase, obtaining of

sanctions from the Ministry and acquisition, installation/ distribution of the same.

2. Monitoring of stocks of seized, confiscated and ripe for disposal goods belonging to the Customs Commissionerates.

3. Inspection and stock taking of anti smuggling wings of the Commissionerates/ Custom Houses.

4. Maintenance of statistical data bank relating to Investigations, Adjudication, Rewards, Prosecutions, stocks and disposal of goods, for Ministry’s use and preparation of monthly Performance Indicators Bulletin.

5. Loaning of appropriated arms to the departmental officers.

6. Acquisition and deployment of Sniffer dogs.

(b). The main functions of the Marine Wing are as follows:

1. Rendering technical support to maritime Commissionerates.

2. Undertake Central procurement and supply of technical and general sea stores through Central Stores Yard, Mumbai.

3. Overall supervision and control over the three workshops for repair of the vessels.

4. Examining proposals for appropriation/ condemnation of vessels received from maritime Commissionerates.

5. Maintaining statistical data pertaining to crafts and crew.

6. Recruitment of trained and disciplined technical personnel for operating vessels, workshops and CSY.

(c). The main functions of the Communication Division are as follows:

1. To plan and formulate wireless communicating proposals for Customs Preventive Commissionerates and obtaining sanctions from the

Ministry for acquisition of wireless equipment.

2. Distribution of wireless equipment amongst the Commissionerates.

3. Monitoring the wireless equipment amongst the Commissionerates.

4. Preparation of consolidated monthly wireless traffic report on the basis of Commissionerate’s monthly traffic reports.

5. Monitoring the operational status of wireless networks in the Commissionerates.

6. Providing support for the maintenance and repair of wireless equipment in the Commissionerates.

7. Inspection of wireless wings in the Commissionerates.

8. Co-ordination with Regional Command Security Committees under Ministry of Defence in the matters related to breaches of communication

security.

9. Co-ordination with the Ministry of Communication for obtaining new licenses and renewal of existing licenses for the operation of wireless

stations in the Commissionerates.

10. Planning and management of Group ‘A’, ‘B’ and ‘C’ telecommunication personnel.

11. Cadre control of Group ‘B’ telecommunication Supdts.

12. Dealing with the court matters related to telecommunication staff.

13. Training of telecommunication staff

Special Equipment Fund

Special Equipment Fund (SEF) was created in 1985 to acquire specialized anti-smuggling equipment in the shortest possible time. Every year 5% of the sale proceeds of confiscated goods credited to the Government and Customs/ Excise duties, fines & penalties in offence cases are credited to SEF.The SEF is administered by a Governing Body under Chairman, CBEC. Principal Commissioner, Directorate of Logistics is the Member Secretary.

This fund has been used to procure Specialised anti-smuggling equipment. Proposals received from the Commissionerates/ Directorates are processed and submitted to the Governing Body for sanction. Since SEF is a public account, it does not lapse every financial year. One of the items procured out of this fund are four High Energy X-Ray Baggage Systems with tunnel size of 180 cm x 180 cm and with extended motorized roller for installation at TFC Chakan-da-Bagh and Salamabad along the line of control in J&K. These systems are big enough to scan large gunny sacks imported at these places.

Container Scanners

With growing international trade, examination of cargo by Customs officers is becoming increasingly difficult. This problem is being addressed by (a) Selective examination using a Risk Management System (RMS); and (b) Through Non-Intrusive Inspection (NII) of cargo using Container Scanner. This not only helps to detect the entry of restricted and prohibited goods into the country but also facilitates speedy clearance of genuine cargo. As a pilot project, One Mobile Gamma Ray Scanner and one 9MeV Fixed X-ray Scanner were installed in 2004 and 2005 at JNPT Port, Nhava Sheva.Gamma Ray Scanner is being de-commissioned and X-ray Scanner is working satisfactorily.

Based on containerized import / export traffic projections, requirement of additional Container Scanners at other ports is being finalised. Till now, this Directorate has installed a total of 12 container scanners, including of one scanner decommissioned, of different types i.e. mobile scanners (3), fixed scanners (4) and drive-thru scanners (3). Private ports are also installing container scanners themselves with the help of this Directorates support in technical specifications. Till now, 3 private ports- Krishnapatnam, Pipapav and Ketupalli have installed drive-thru Scanners. About 18 nos. of scanners ( 13 mobile, 4 Drive-thru (Road) scanners and 1 Rail Scanner) are under process of installation. Eight (8) mobile scanners, procured by IPA, are at advanced stage and will be installed by December, 2019. The Drive through Scanner has a throughput about ten times the throughput of fixed scanners whereas by installing rail scanners at gateway ports, Containers moving by rail to any ICD, located at hinterlanb e scanned and the image saved on a server & subsequently can be viewed by the examiner at the ICD.

Procurement of new Customs Marine Vessels:

The Directorate has modernized the Customs Marine Fleet by acquiring new 109 high speed sophisticated Customs Marine vessels. These vessels are of state of art technology. The supply of these vessels commenced in the year 2008 and completed in May 2012. These vessels have been allocated & deployed at various ports/ riverines under jurisdictional Commissionerates. The old marine fleet (comprising of vessels acquired during 1974-95 out of which a large number were appropriated & confiscated vessels) which outlived their life and not seaworthy have been phased out. This new fleet comprises of 24 Customs Patrol Vessels, 22 Customs Interceptor Crafts and 63 Customs Patrol Tenders (CPT)

Other Anti-smuggling Equipments:

1. The Anti-smuggling Equipment such as X-Ray Baggage Systems (XBIS), High Energy X-Ray Cargo Pallet Scanners (HEXS), Explosive and

Narcotic Detectors, Door Frame Metal Detectors (DFMD), Hand Held Metal Detectors (HHMD), Hand Held Search Lights (HHSL), Binocular

Devices etc. have been provided to all Customs and Customs Preventive formations functional under CBEC

2. A total no. of 204 X-Ray Systems of Conventional Energy have been installed at various Airports, ACC, LCS, FPO etc. which also includes the Four High Energy X-Ray Pallet

Systems are being procured by the Directorate which have been installed at TFC Chakan-da-Bagh and Salamabad. Both these conventional

energy and high energy systems function on basic multi-energy technology. Further, procurement of 82 nos. of XBIS is under process.

15 X-ray Mail Scanners have also been procured, out of which 13 are installed at FPOs. FPOs are also being equipped with XBIS, XMIS, Carat Meter, Narcotics explosive devices etc.

3. The XBIS and HEXS installed in all Customs field formations has been provided with comprehensive centralized maintenance cover

4. Besides above, 78 locations have been equipped Video Conferencing Systems managed by M/s RailTel connecting Board with all Pr. CC/CC/Pr.DG/DG/NACIN RTIs and some other important offices.

1% Incremental Revenue Scheme:

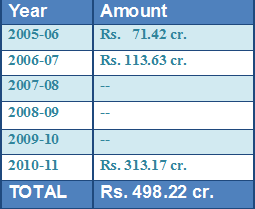

With a view to encouraging greater effort at garnering revenues to the Government, a scheme under which an amount equal to 1% of the incremental revenue has been earmarked as incentive provision for enhancing the organizational efficiency, infrastructure and wherewithal has been introduced by the Government in 2006-07 vide Department of Expenditure O.M. No. 7(3)-Coord/2006 dated 22nd July 2006 for revenue generating/earning/ collecting Ministries/ Departments.

The Department works out the details of relevant schemes based on the principle of enhanced provisions for augmenting operational efficiency arising out of the incremental revenues earned beyond the budget targets.

For implementation of the 1% Incremental Revenue scheme, two Committees have been constituted by the Board for formulating proposals for utilization of funds under the scheme. The first Committee is headed by DG (HRD) and comprises Commissioner (Coord.), Commissioner (Anti-Smuggling), ADG (I & W), Commissioner (Logistics), F.A. or his nominee, and one representative each from Directorate of Systems, DG, NACEN, Pr. CCA, CBEC as special invitee. The second Committee comprises three Director Generals, namely, DG (CEI), DG (RI), and DG (HRD). Commissioner (Logistics) is the Nodal officer for implementation of 1% Incremental Revenue scheme.

Schemes/proposals for utilization of funds under the scheme are formulated on the basis of the following broad guidelines suggested by IFU:

° Schemes should be formulated for improving the permanent infrastructure or assets and intended towards long-term benefits of the

Department.

° Schemes which are basically consumption oriented and recurring in nature should be avoided.

Proposals/suggestions received from field formations are scrutinized as per the above broad guidelines at the level of Commissioner (Logistics). The proposals found in conformity of the broad guidelines for formulating the proposals are placed for consideration of the Board through the two Committees, constituted for utilization of funds available under the scheme. Proposals approved by the Board are submitted to IFU for obtaining sanction of the competent authority

The details of money entitled to the Department as incentive under 1% Incremental Revenue scheme for exceeding the budgetary targets is given below

Out of Rs. 498.22 crore, a sum of Rs.296.69 crore has been sanctioned/ utilized on various purposes upto 2018-19:

Following are the details of some early purchases under 1% Incremental Scheme :

(i) Modernization/ improvement of infrastructure in Indirect Taxs, Customs and Service Tax Ranges.;

(ii) Capacity building and modernization of Library at NACEN, Faridabad.

(iii) Management courses for senior IRS officers at IIMs.

(iv) Capacity building of PAOs offices.

(v) Providing laptops to Group-A officers of the Department and for important functions like audit, legal, preventive, anti-evasion etc. in the field

formations for improvement/ monitoring of tax collection, investigation and intelligence work.

(vi) Hiring of vehicles for increasing organizational efficiency and outdoor preventive activities.

(vii) Reimbursement of mobile phone charges to officers working in the field so as to remain in touch with senior officers at Headquarters.

(viii) Providing better facilities for Driver’s room/ Control rooms, Group-D staff and remotely located Customs formations.

(ix) Purchase of a mini bus for RTI, Chennai.

(x) Renovation/furnishing of mini hall for use as Auditorium at RTI, Mumbai.

(xi) Training of Group-D staff of Customs Commissionerate, Lucknow.

(xii) Rain harvesting System at Indirect Taxs, Cochin.

(xiii) Solar powered street lighting system in departmental colony at Nasik.

(xiv) LCD TVs, Heavy duty Scanners/ Photocopiers, Solar Geysers, etc.

In the year 2011-12, the Board has given ‘in principle’ approval for the following proposals, which were having twin objectives of improving tax administration and staff welfare

1. Provision of Laptops to all Group-B (Gazetted) and identified Group-C officials

2. Motorcycles for Inspectors

3. Augmentation of fleet of operational vehicles

4. Development of Guest House and transit accommodation in Chennai

5. The Resource Centre cum Library (RCCL) at NACEN, Regional RCCL at RTI, TRU RCCL at TRU (CBEC) & Field RCCLs at 34 Chief

Commissionerates

6. Mid-career training programmes for IRS (C & CE) officers

7. Air-conditioning of Divisional and Range offices

8. Camp office at residence of JC and above officers (Project leader: Commissioner Customs (Import & General), Delhi)

Recent purchases under 1% Scheme are below:

Proposals approved under 1 % Scheme during FY 2016-17:

1. Purchase of 1400 Laptops for Group A officers of CBIC

2. Floating Jetties by Pune Customs

3. 200 Laptops by NACIN

4. 45 laptops by DG Audit

5. Cyber Forensic Lab by DGCEI, DZU

Proposals approved under 1 % Scheme during 2017-18

1. Provisioning of LED lights in Custom House (both interior and exterior) by Customs, Chennai

2. Purchase of 24 laptops for Category-I boats by Marine Wing, Directorate of Logistics

3. Purchase of 6 Porta Cabins and installation of 5 Solar Panel Systems by Customs (Prev.) Commissionerate, Patna

4. Upgradation of Revenue Laboratory, Custom House, Chennai, through CPWD by Chief Commissioner of Customs, Chennai

5. Provisioning of LED lights in Chennai Airport Commissionerate through CPWD by Chief Commissioner of Customs, Chennai

6. Purchase of 80 motorcycles by DGGSTI, for 40 Regional Units, 26 Zonal Units and DGGSTI (Hqrs.)

7. Purchase 1 Porta Cabin and 4 Solar Panels by Customs (Prev), Lucknow

8. Purchase of 100 two wheelers by DRI, New Delhi

9. Purchase of 6 laptops for GST Policy Wing, CBEC

10. Purchase of 125 laptops by NACIN, Faridabad

11. Purchase of 60 laptops by DG Systems

12. Purchase of 38 laptops by DGRI

13. Purchase of 33 laptops by DG Systems (for RMD)

14. Purchase of 24 laptops for FPOs by Directorate of Logistics

Proposals approved under 1 % Scheme during FY 2018-19

1. Purchase of 13 Porta Cabins by Customs (Prev.), Kolkata;

2. Purchase of 30 Motorcycles by Customs (Prev.), Kolkata;

3. Purchase of 2 Porta Cabins by Customs (P), Cochin;

4. Purchase of 11 Solar Panel Systems by Customs(P), Lucknow;

5. Setting up of Customs Canine Centre at ICP Attari (Punjab) by Directorate of Logistics, New Delhi through the Commissioner of Customs (P), Amritsar;

6. Setting up a Centralized Sampling Cell at Record Room behind DPD Cell at Chennai Customs by Chief Commissioner of Customs, Chennai;

7. Purchase of 30 laptops by the office of CC (AR), CESTAT, New Delhi;

8. Purchase of 155 laptops by DGGSTI, New Delhi;

9. Purchase of 25 laptops by DG, Vigilance, New Delhi;

10. Installation of 09 Gantry Sign Boards followed by Checking Barrier at Entry/ Exit point of Indo-Nepal Border of LCS by Customs (P), Patna;

11. Provision of G.I. Chain link fencing and 20 (twenty) steel kennels at Customs Canine Centre at ICP Attari in Punjab by Directorate of Logistics, New Delhi through the Commissioner of Customs (P), Amritsar;

12. Procurement of 04 (four) laptops for official use by Directorate General of Export Promotion;

13. Proposal for setting up the Machine Intelligence Unit at DGGI, Hqrs., Delhi;

14. Purchase of 02 (Two) Portable Cabins for Sea Patrol Unit, Beypore and Customs Preventive Unit Kasaragode by Commissioner of Customs (P), Cochin;

15. Purchase of 14 motorcycles (06 nos. of Enfield Motorcycles for field formations &Hqrs Anti-Evasion for CGST Itanagar and 8 nos. of Bajaj Pulsar-180 DT Si BS4 Motorcycle for Customs, Preventive, Shillong) by the Chief Commissioner of CGST & Customs, Shillong;

16. Proposal for purchase of Four (04) laptops by Directorate of Legal Affairs, New Delhi;

17. Purchase of 04 (four) motorcycles one each for each wharf and 2 (two) for SIIB of Custom House by Commissioner of Customs, Cochin

18. Purchase of Five laptops for the office of Commissioner (Single Window Project), New Delhi, by Directorate of Logistics;

19. Purchase of Five laptops for the office of Commissioner (Investigation-Customs), New Delhi, by Directorate of Logistics;

20. Purchase of Five laptops for the office of Anti Smuggling Unit, CBIC, by Directorate of Logistics;

21. Purchase of Ten motorcycles (of suitable specifications) by the Commissioner of Customs (P), Jodhpur, Hqrs at Jaipur;

22. Procurement of Thirteen Solar Panels for 11 Porta Cabins at LCSs by the Chief Commissioner of Customs, Kolkata.

Videoscope:

Videoscope is one of the non-intrusive contraband detection equipment, which provides clear images of inaccessible areas thus making remote inspection, evaluation and imaging possible in almost any situation. This Directorate has procured 90 Videoscopes in the year 2017 and these have been deployed at Customs stations.

Carat Meter:-

Carat meter is equipment used for determining the actual contents of gold, silver, platinum and other precious metals utilizing non-destructive methods.

1. 18 nos. Carat Meters were procured and installed during 2015-16 at different Airports/ ACC/Customs Houses of the field formations. The equipments are currently under CCAMC as two years warranty period is over.

2. Further, 24 nos. Carat Meters were procured and installed at Airports/ACC/FPOs/Customs Houses during 2018-19. The equipments are under warranty period.

Other Projects:

This Directorate has submitted the following proposals to Ministry for consideration.

1) Setting up a special canine detection establishment for detection of narcotics, fake currencies and hazardous material / ammunition.

2) Setting up of physical and weapon training institute for the executive officers and staff of Customs.

3) Providing Carat meters and Radio Isotopes Identifiers to the field formations.